Breaking Down Business Barriers: Why 10,000+ Entrepreneurs Choose Doola for U.S. Company Formation. In today’s interconnected world, launching a U.S. business has become a strategic move for entrepreneurs worldwide. But navigating the complex maze of American business regulations, tax requirements, and compliance standards can feel overwhelming. That’s where Doola steps in, transforming what was once a daunting process into a streamlined journey for over 10,000 successful business owners.

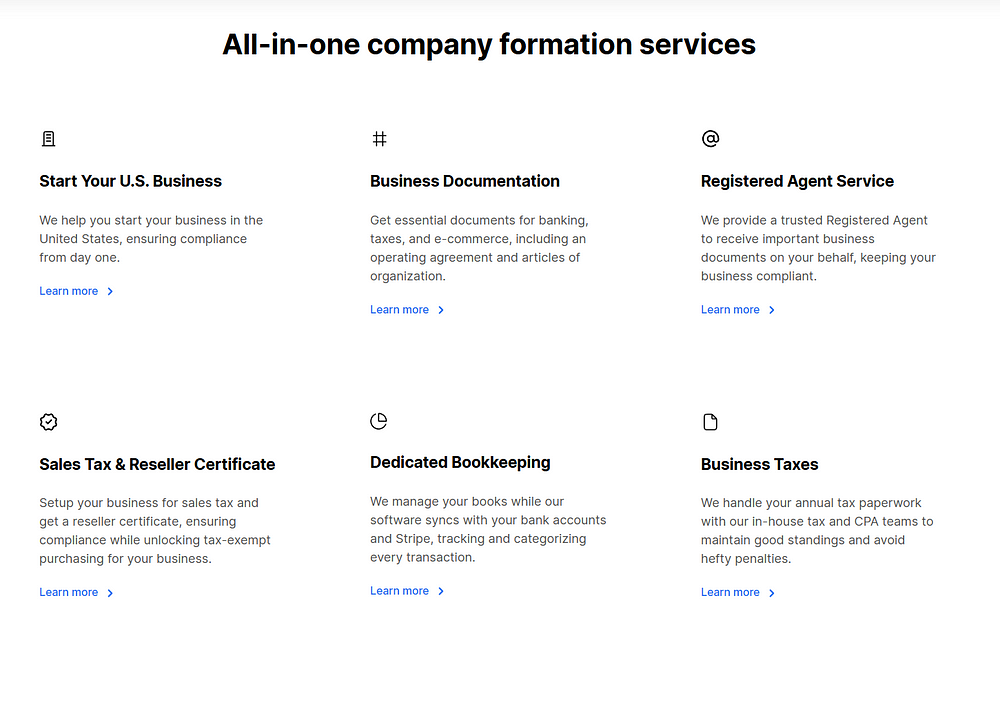

Understanding Doola’s Core Services

When you’re ready to establish your U.S. business presence, Doola offers a comprehensive suite of services designed to handle every crucial aspect of your company formation. Their platform enables you to:

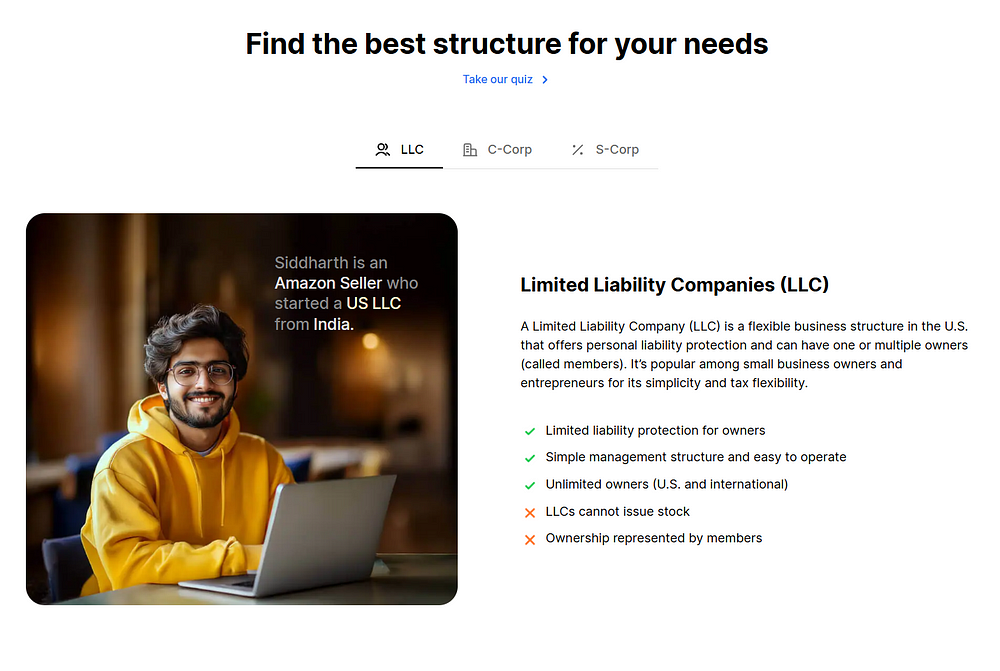

- Form an LLC, C-Corp, or S-Corp in any U.S. state

- Receive essential formation documents and operating agreements

- Access a dedicated registered agent service

- Set up sales tax registration and obtain reseller certificates

- Connect with U.S. banking services through trusted partners

- Manage ongoing compliance and tax obligations

The Formation Process Simplified

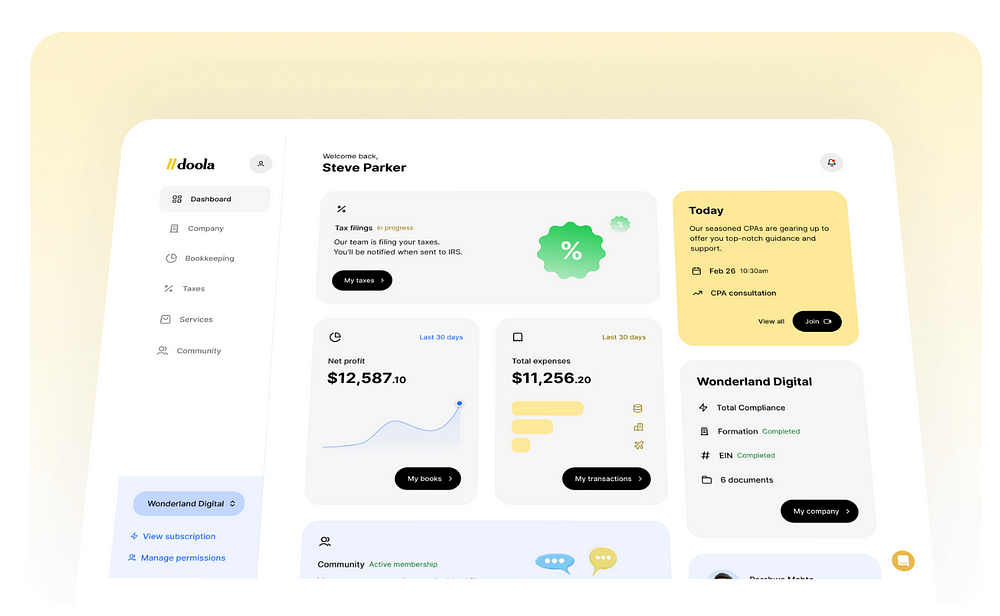

Your journey with Doola begins with their intuitive dashboard, where you’ll provide basic information about your company and its members. The streamlined process typically takes:

- Under an hour to submit your initial information

- About a week for U.S. residents to receive completed formation documents

- A few additional days for international entrepreneurs

What sets Doola apart is their attention to detail during this critical phase. Your formation package includes all necessary documentation, from Articles of Organization to EIN registration, ensuring you’re fully prepared to operate legally in the United States.

Pricing and Package Comparison

Doola’s pricing structure is designed to match your business needs and growth stage:

Starter Plan:

- Essential formation services

- Basic compliance support

- Perfect for solo entrepreneurs or small startups

Total Compliance Package:

- Everything in Starter

- Enhanced compliance management

- Annual tax filing support

- Ideal for growing businesses

Total Compliance Max:

- All previous features

- Dedicated bookkeeper

- Premium support services

- Best for established businesses needing comprehensive assistance

Beyond Formation: Ongoing Support

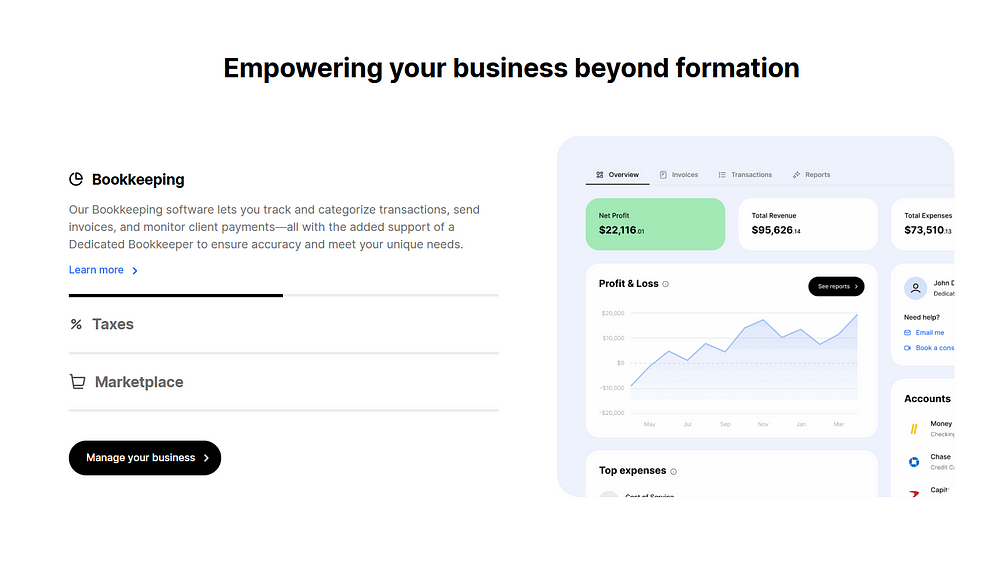

Your relationship with Doola doesn’t end after formation. Their platform provides:

- Continuous compliance monitoring

- Tax preparation and filing by in-house CPAs

- Bookkeeping services that sync with major payment platforms

- Regular updates about regulatory changes affecting your business

How Doola Stands Out

In a market with established players like LegalZoom and Stripe Atlas, Doola distinguishes itself through:

- Integrated ecosystem approach

- Competitive pricing

- Specialized focus on international entrepreneurs

- Strong backing from Y Combinator and other notable investors

- Comprehensive ongoing support services

Real User Experiences

The platform’s success is reflected in its growing user base and positive feedback. Entrepreneurs particularly appreciate:

- The straightforward formation process

- Responsive customer support

- Clear pricing structure

- Comprehensive service integration

Making Your Decision

When evaluating Doola against competitors, consider:

- Your business’s specific needs

- Growth plans

- Budget constraints

- Desired level of ongoing support

Their all-in-one solution often proves more cost-effective than piecing together services from multiple providers.

Getting Started Guide

Ready to launch your U.S. business? Here’s your action plan:

- Choose your business structure (LLC, C-Corp, or S-Corp)

2. Select the appropriate Doola package

3. Gather required documentation:

- Personal identification

- Business plan basics

- Member/owner information

4. Complete the online registration process

5. Wait for your formation documents

6. Set up your U.S. banking relationship

7. Begin operations with ongoing Doola support

Your journey to U.S. business ownership doesn’t have to be complicated. With Doola’s comprehensive platform and support system, you can focus on growing your business while they handle the complex compliance and administrative tasks.