How Synder’s Accounting Automation Can Transform Your E-commerce Business Operations. If you’ve ever found yourself drowning in spreadsheets at month-end, manually reconciling transactions from multiple sales channels, or struggling to properly recognize revenue from subscription services, you’re not alone. For small to medium-sized enterprises (SMEs) and growing businesses, accounting complexity increases exponentially with each new sales channel or subscription model you adopt. This is precisely the pain point that San Francisco-based Synder set out to address when it launched in 2019.

As your business grows, the systems that once seemed adequate begin to show their limitations. Manual data entry becomes error-prone and time-consuming. Reconciliation turns into a multi-day affair. Revenue recognition for subscriptions becomes a compliance headache. What if there was a way to automate these processes while maintaining accuracy and compliance? This is where Synder enters the picture, offering a suite of tools designed specifically for businesses that have outgrown basic accounting solutions but don’t need (or want to pay for) enterprise-level complexity.

The Evolution of Accounting Software for E-commerce Businesses

The accounting landscape for online businesses has changed dramatically over the past decade. Initially, businesses relied on general accounting software that wasn’t designed for e-commerce operations, forcing owners and accountants to create workarounds and manual processes to bridge the gap.

The first wave of specialized solutions focused primarily on syncing transactions from a limited number of platforms like Amazon or Shopify. These point solutions solved immediate problems but created new silos of information. As businesses expanded to multiple channels, they found themselves juggling several integration tools alongside their accounting software.

You may have experienced this evolution firsthand — perhaps starting with manual entry, progressing to basic integrations, and now finding yourself in need of a more comprehensive solution that can handle multiple channels, subscription billing, and provide analytics that help you make informed business decisions.

Synder represents the next evolution in this space: a comprehensive platform that not only handles data synchronization but also addresses complex accounting challenges like revenue recognition while providing actionable business intelligence.

Understanding Synder’s Core Offerings

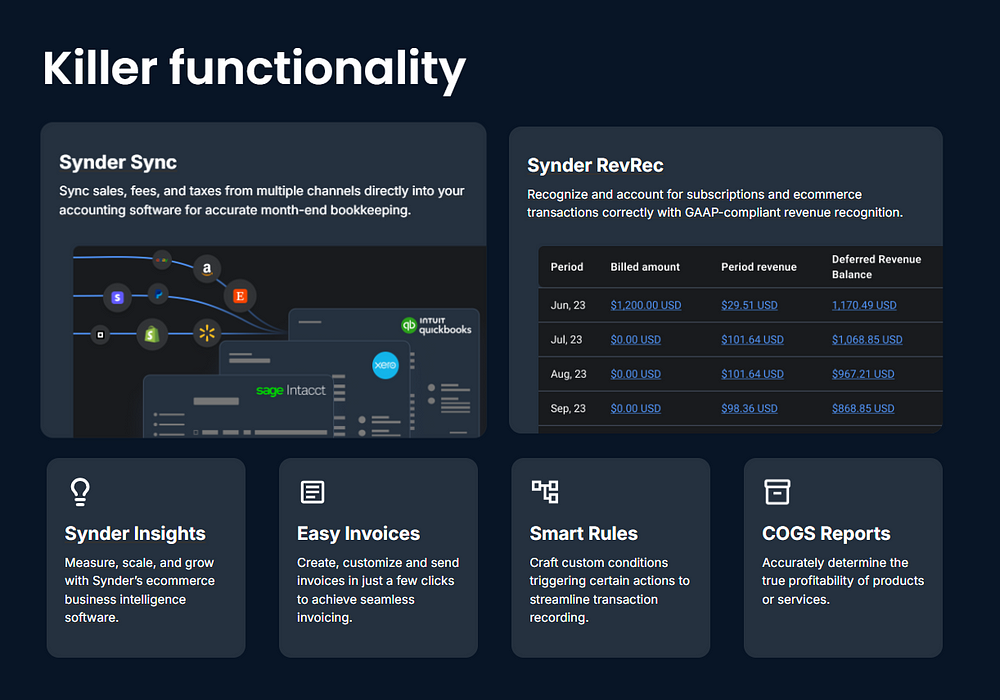

Synder’s platform consists of three main components, each addressing a specific aspect of financial management for e-commerce and subscription-based businesses:

- Synder Sync: Focuses on accurate data transfer from sales platforms to accounting software

- Synder RevRec: Handles GAAP-compliant revenue recognition

- Synder Insights: Provides business intelligence and analytics

Each component can work independently or as part of an integrated solution, giving you the flexibility to adopt what you need based on your business’s current challenges.

Synder Sync: Streamlining Your Multi-channel Data

If your business sells across multiple platforms — perhaps a combination of your own website, Amazon, Etsy, eBay, and others — you understand the challenge of getting a consolidated view of your finances. Synder Sync addresses this by connecting to over 30 e-commerce platforms and payment processors, including popular options like Shopify, WooCommerce, Square, PayPal, and Stripe.

What sets Synder Sync apart is its flexibility in how it transfers data to your accounting platform, whether that’s QuickBooks Online, QuickBooks Desktop, Xero, or Sage Intacct. You can choose between:

- Summary mode: Consolidates transactions into daily or weekly summaries, reducing clutter in your accounting system

- Detailed mode: Transfers each transaction individually, maintaining a complete audit trail

The platform goes beyond simple transaction recording, handling complex scenarios like:

- Proper categorization of sales tax by jurisdiction

- Accurate recording of marketplace fees and commissions

- Reconciliation of payment processor settlements against individual transactions

- Handling of refunds, chargebacks, and other adjustments

This automation eliminates the manual reconciliation process that typically consumes days of work each month, allowing you to close your books faster and with greater confidence in the accuracy of your financial statements.

Synder RevRec: Solving the Revenue Recognition Puzzle

If your business deals with subscriptions, membership models, or invoices with extended payment terms, you’ve likely encountered the challenges of proper revenue recognition. Accounting standards require that revenue be recognized as it’s earned, not necessarily when payment is received — a principle that’s simple in concept but complex in execution.

Synder RevRec automates this process, building GAAP-compliant recognition schedules based on your subscription data from platforms like Stripe. For example, if a customer pays $1,200 upfront for an annual subscription, Synder automatically recognizes $100 each month over the subscription period, rather than recording the full amount as revenue when received.

This automation is particularly valuable in scenarios such as:

- SaaS subscriptions with various billing frequencies

- Service contracts with milestone-based deliverables

- Product bundles that include both physical goods and digital services

- Contracts with varying start and end dates

By automating revenue recognition, you not only ensure compliance with accounting standards but also gain a more accurate picture of your business’s monthly performance, essential for making informed decisions about pricing, marketing, and resource allocation.

Synder Insights: Turning Data into Actionable Business Intelligence

With data flowing accurately into your accounting system and revenue being recognized appropriately, Synder Insights completes the picture by transforming this financial data into actionable business intelligence.

Unlike generic reporting tools, Synder Insights is specifically designed for multi-channel e-commerce and subscription businesses. It allows you to:

- Track performance across all sales channels on a unified dashboard

- Analyze product performance beyond simple sales totals

- Understand customer lifetime value and purchasing patterns

- Monitor key metrics like customer acquisition cost and return rates

- Compare performance across time periods, channels, and product categories

The platform goes beyond static reports, offering interactive visualizations that help you identify trends and opportunities that might otherwise remain hidden in spreadsheets or accounting software. You can drill down from high-level overviews to transaction-level details when needed, giving you both the big picture and the specific insights required to take action.

Industry Applications: How Different Sectors Benefit

While Synder’s core functionality benefits any business with multi-channel sales or subscription revenue, the platform offers specific advantages for different industries:

Retail & Consumer Goods

For retail businesses, Synder provides a unified view of inventory and sales across all channels, helping you identify which products perform best on which platforms. This information is crucial for inventory planning and marketing resource allocation.

The platform also helps track product returns and exchanges, providing insights into quality issues or customer satisfaction challenges that might not be immediately apparent from sales data alone.

Technology & SaaS

If you run a SaaS business, Synder helps you track crucial metrics like Monthly Recurring Revenue (MRR), churn rate, and customer lifetime value. The revenue recognition functionality ensures your financial statements accurately reflect the economics of your subscription business, essential for both compliance and strategic planning.

The platform can also help you understand the impact of different pricing tiers and upsell opportunities, providing data to optimize your subscription offerings.

Accounting Firms

For accounting professionals serving e-commerce and subscription clients, Synder provides a way to automate routine bookkeeping tasks, allowing you to shift your focus to higher-value advisory services. The standardized approach to data synchronization and revenue recognition helps maintain consistency across your client base.

The platform’s audit trails and documentation capabilities also streamline the year-end audit process, reducing the time and cost associated with financial statement preparation and review.

Marketing Agencies

Marketing agencies that handle e-commerce for clients can use Synder to demonstrate the ROI of their services by directly connecting marketing activities to sales results. The platform’s multi-channel reporting capabilities help identify which platforms and campaigns generate the highest returns.

For agencies billing on a retainer or subscription basis, the revenue recognition functionality ensures proper matching of revenue to the periods when services are delivered.

Nonprofits & Associations

Nonprofit organizations benefit from Synder’s ability to track donations and membership dues across multiple platforms. The revenue recognition functionality is particularly valuable for handling multi-year memberships or grants with specific performance obligations.

The reporting capabilities help nonprofits demonstrate program effectiveness and financial stewardship to donors and board members.

Comparing Synder with Market Alternatives

To determine if Synder is the right solution for your business, it’s helpful to understand how it compares to other players in the accounting automation space. Based on features, pricing, and customer reviews, here’s how Synder stacks up against some key competitors:

BILL AP/AR (formerly Bill.com)

While both platforms offer automation, BILL focuses primarily on accounts payable and receivable workflows, including invoice processing and payment collection. Synder’s strength lies in its e-commerce integrations and revenue recognition capabilities.

BILL may be a better fit for service businesses with complex vendor relationships, while Synder excels for businesses selling products across multiple channels or offering subscription services.

Webgility

Webgility shares Synder’s focus on e-commerce integration but places greater emphasis on inventory management. Synder offers more comprehensive revenue recognition capabilities and business intelligence features.

If your primary challenge is inventory management across channels, Webgility might be worth considering. If your concerns center on proper accounting, revenue recognition, and financial analytics, Synder likely offers a more complete solution.

Invoiced

Invoiced specializes in accounts receivable automation, with features for invoice delivery, payment collection, and dunning management. While valuable for businesses with custom invoicing needs, it lacks Synder’s breadth of e-commerce integrations.

For businesses primarily dealing with custom invoices and payments, Invoiced may be sufficient. Multi-channel e-commerce businesses will find Synder’s broader platform more comprehensive.

Segment

While not directly an accounting solution, Segment competes with Synder’s analytics capabilities by focusing on customer data collection and utilization. Segment offers broader data collection capabilities but lacks the direct accounting integration and financial focus of Synder.

Businesses looking primarily for customer journey analytics might prefer Segment, while those seeking financial analytics tied directly to accounting data will find more value in Synder.

The Synder Advantage

What sets Synder apart from these alternatives is its comprehensive approach to the e-commerce and subscription accounting workflow. Rather than solving a single piece of the puzzle, Synder addresses the entire process from data collection to analysis, with specific attention to the unique challenges of multi-channel selling and subscription billing.

The platform’s SOC 2 Type II certification also demonstrates a commitment to security and compliance that’s essential when handling sensitive financial data. Combined with 24/7 customer support, this makes Synder particularly attractive for businesses that can’t afford downtime or data security issues.

Conclusion: Is Synder Right for Your Business?

If your business has outgrown basic accounting solutions but doesn’t need the complexity and cost of enterprise-level systems, Synder offers a compelling middle ground. It’s particularly well-suited for businesses that:

- Sell across multiple online channels

- Offer subscription services or products

- Need to comply with GAAP revenue recognition requirements

- Want to make data-driven decisions based on consolidated financial information

- Value security and support in their financial systems

The platform’s modular approach allows you to start with the components most relevant to your current challenges and expand as needed. Whether you’re struggling with data synchronization, revenue recognition, or business analytics, Synder provides a pathway to automation that grows with your business.

As e-commerce and subscription models continue to evolve, the complexity of financial management will only increase. Solutions like Synder help you stay ahead of this complexity, turning what could be a competitive disadvantage into an opportunity for greater efficiency and insight.