Stop Chasing Payments: How Melio Can Revolutionize Your Accounts Payable and Receivable. Is Your Accounts Payable/Receivable Process a Mess?

Are you still drowning in paper checks, manually tracking invoices, and spending countless hours chasing down payments? If you’re a small business owner, you know how time-consuming and frustrating managing accounts payable and receivable can be. It’s a necessary evil, but it doesn’t have to be so painful.

It’s time to discover Melio Payments, a comprehensive platform designed to streamline your accounts payable and receivable processes and give you back control of your finances.

What is Melio Payments and Why Should Small Businesses Care?

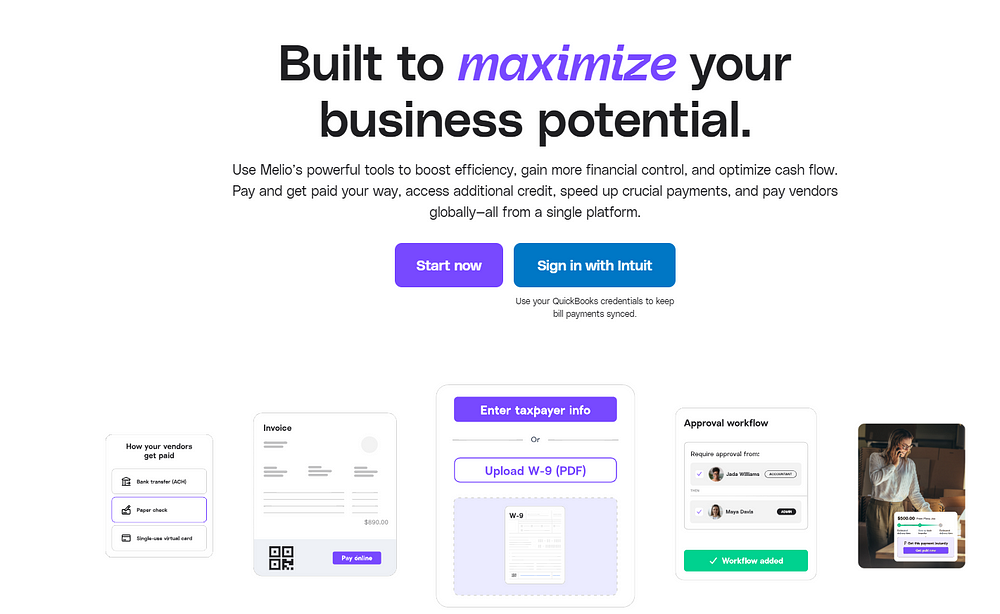

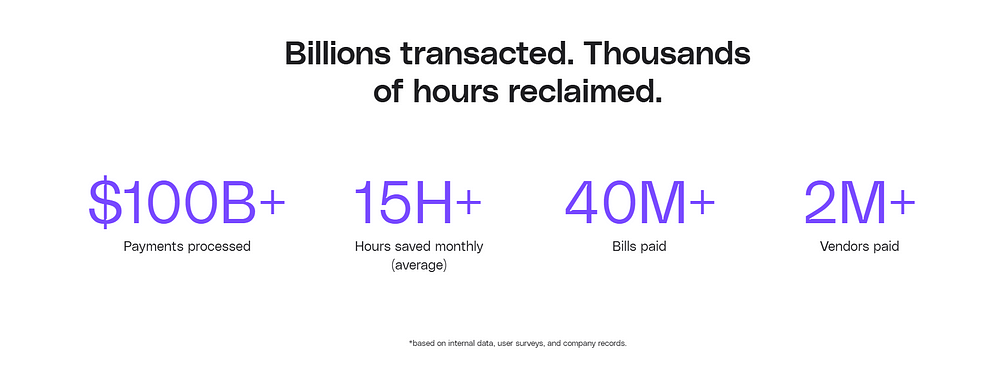

Founded in 2018, Melio Payments is a financial technology company on a mission to maximize your business potential by providing tools that enhance efficiency, financial control, and cash flow management. They understand the unique challenges that small businesses face and have built a platform specifically designed to address those needs.

Melio aims to give you the tools to:

- Pay and receive payments according to your preferences.

- Access additional credit to manage cash flow.

- Expedite essential payments when you need to.

- Pay vendors globally with ease.

All from a single, user-friendly interface.

If you’re a small business owner looking for a better way to manage your finances, Melio Payments is worth a serious look.

Key Features: How Melio Simplifies Your Finances

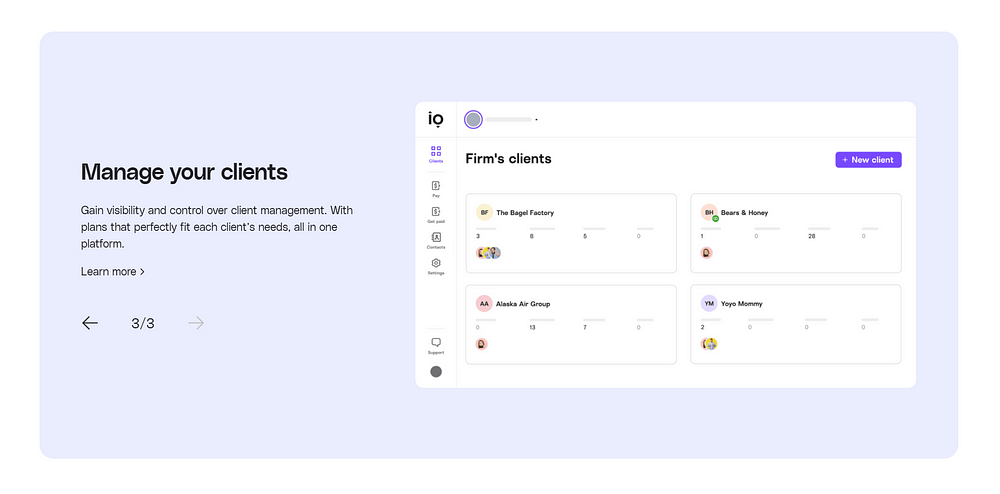

Melio Payments offers a range of features designed to simplify your accounts payable and receivable processes:

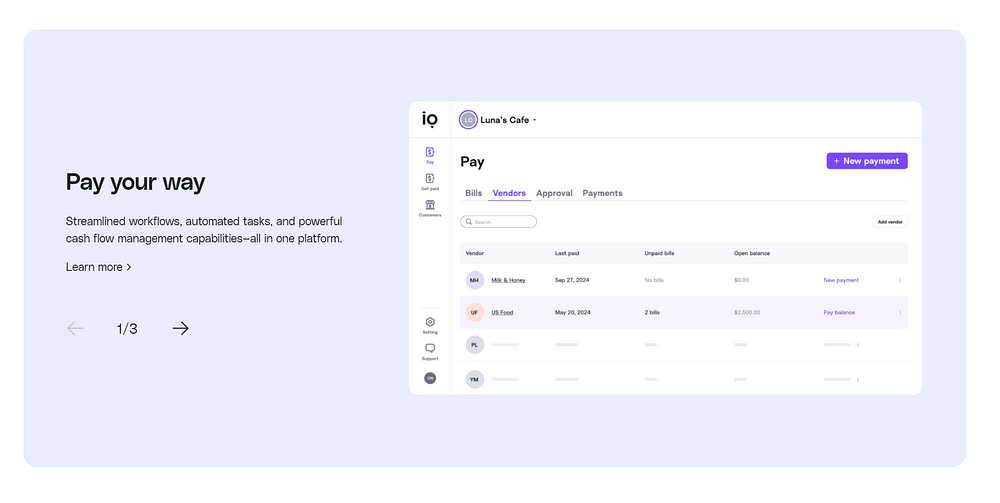

- Accounts Payable: Streamlined workflows, automated tasks, and robust cash flow management capabilities allow you to manage your outgoing payments efficiently.

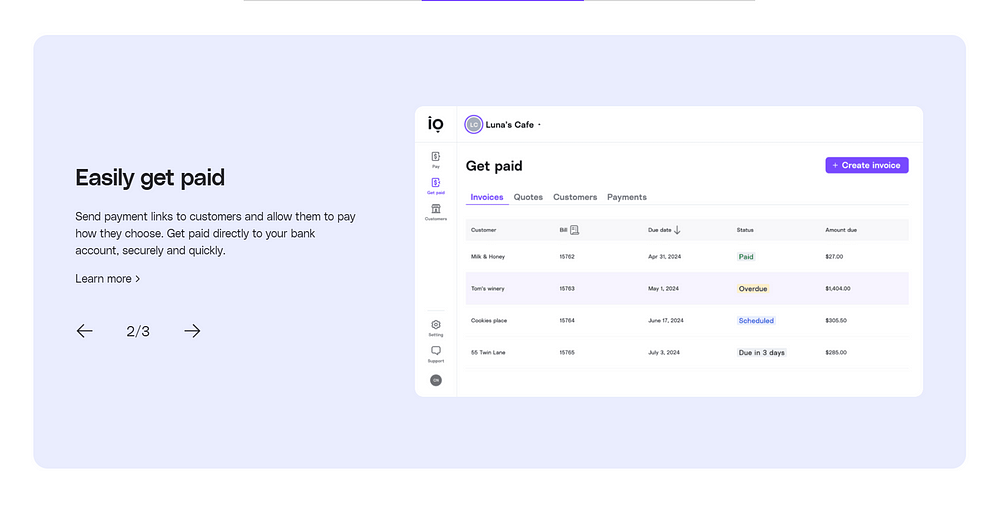

- Accounts Receivable: Facilitates quick and secure payment collection by enabling you to send payment links to customers, allowing them to pay through various methods directly into your business’s bank account.

- Integration with Accounting Software: Seamlessly integrates with popular accounting platforms like QuickBooks and Xero, ensuring that all payment data is automatically synchronized and up-to-date.

- Payment Flexibility: Choose different payment methods and speeds that align with your operational needs, optimizing cash flow without altering how vendors receive payments. Options include ACH, credit card (even if the vendor doesn’t accept them!), and paper checks sent by Melio.

- International Payments: Supports global transactions, allowing you to pay vendors in their preferred currencies with competitive exchange rates and transparent fees.

- Security: Employs industry-leading security measures, including compliance with PCI data security standards, multi-factor authentication, 24/7 security monitoring, and advanced DDoS protection.

Diving Deeper: Real-World Examples of Melio in Action

Let’s look at some specific scenarios where Melio can make a real difference:

- Accounts Payable: A local bakery needs to pay its flour supplier but wants to use a credit card to earn rewards points. The supplier doesn’t accept credit cards. With Melio, the bakery can pay with its credit card, and Melio will send the supplier a check.

- Accounts Receivable: A freelance web designer wants to make it easy for clients to pay their invoices. With Melio, they can send a payment link directly to clients, who can pay securely with their preferred method.

- Global Payments: A small business imports goods from a supplier in China. With Melio, they can pay the supplier in their local currency with competitive exchange rates and transparent fees.

- Integration with Accounting Software: A growing company uses QuickBooks to manage its finances. Melio seamlessly integrates with QuickBooks, automatically syncing all payment data and eliminating the need for manual data entry.

Security Matters: How Melio Keeps Your Financial Data Safe

When it comes to your finances, security is paramount. Melio takes security seriously, employing industry-leading measures to protect your data:

- PCI Compliance: Melio complies with Payment Card Industry Data Security Standards (PCI DSS) to ensure the safe handling of credit card information.

- Multi-Factor Authentication: Adds an extra layer of security to your account by requiring a second verification method (e.g., a code sent to your phone) in addition to your password.

- 24/7 Security Monitoring: Continuously monitors its systems for suspicious activity and potential threats.

- DDoS Protection: Protects its platform from distributed denial-of-service (DDoS) attacks, which can disrupt service and compromise security.

Melio Payments vs. The Competition: Alternatives for Streamlining Finances

Melio isn’t the only player in the accounts payable/receivable space. Here’s a quick look at some of its competitors:

- Plastiq: Similar to Melio, Plastiq enables businesses to use credit cards for payments, even to vendors that don’t accept them directly.

- Veem: Offers a global payment platform that allows businesses to send and receive payments both domestically and internationally, emphasizing multi-currency transactions.

- Zeller: While based in Australia, Zeller provides integrated payment solutions, including terminals and transaction accounts, that can be relevant for small businesses seeking a comprehensive approach.

Consider your specific needs and priorities when choosing a platform.

Is Melio Right For You? Key Considerations Before You Sign Up

Before signing up for Melio, consider the following:

- Size of Business: Melio is primarily designed for small to medium-sized businesses.

- Industry: Melio can be used by businesses in a wide range of industries.

- Payment Needs: Consider the volume and types of payments you make and receive.

- Integration Requirements: Ensure Melio integrates with your existing accounting software.

Getting Started with Melio: A Step-by-Step Guide

Ready to take control of your finances with Melio? Here’s how to get started:

- Sign up for an account: Visit the Melio Payments website and sign up for a free account.

- Connect your bank account: Securely connect your bank account to Melio.

- Pay or receive payments: Start paying vendors or sending payment requests to customers through the Melio platform.

Take Control of Your Finances with Melio Payments

If you’re tired of the hassle and inefficiency of traditional accounts payable and receivable processes, Melio Payments offers a powerful solution. With its comprehensive features, seamless integrations, and commitment to security, Melio can help you streamline your finances and focus on what matters most: growing your business.

Ready to take control of your finances?

Visit the Melio Payments website today to learn more and sign up for a free account.