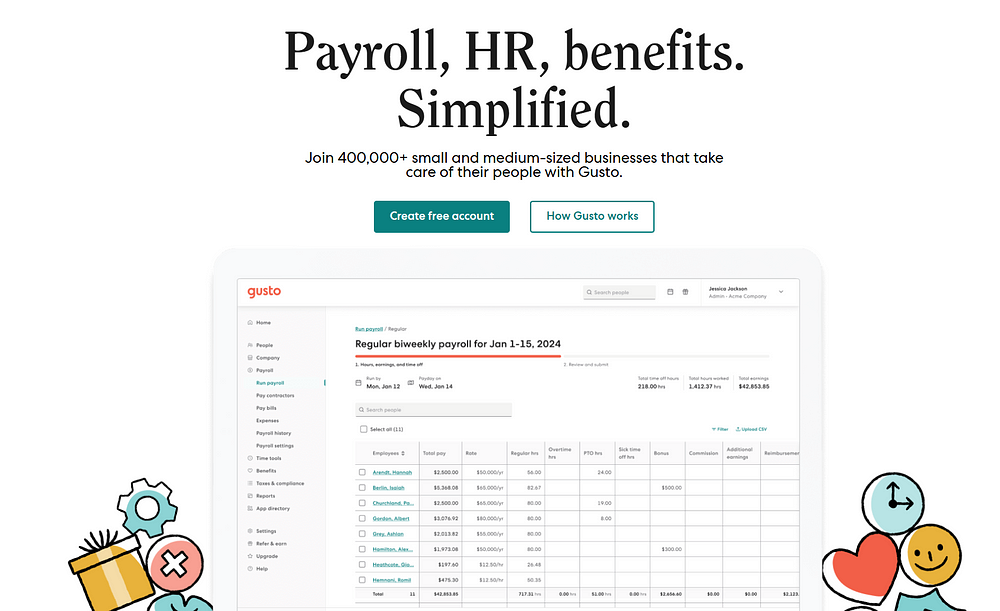

Why Over 400,000 Companies Trust Gusto for Their Payroll and HR Needs. Gusto: Transforming Payroll, HR, and Benefits Management for Small Businesses. You’ve started your own business or are running a growing company, and while you excel at your core service or product, the administrative side of things is becoming increasingly complex. Payroll, taxes, benefits, onboarding — these essential functions can quickly consume hours of your week that could be better spent growing your business.

This is precisely the problem that Gusto set out to solve. As a comprehensive platform serving over 400,000 businesses across the United States, Gusto has positioned itself as the go-to solution for small and medium-sized businesses looking to streamline their payroll, HR, and benefits management.

But with several competitors in the market, including Rippling, ADP, Paychex, OnPay, and Justworks, you might be wondering if Gusto is truly the best fit for your specific needs. Let’s dive into what makes Gusto stand out, how it compares to alternatives, and whether it’s the right solution for your business.

The Gusto Advantage: Simplifying Complex Business Operations

Running payroll used to be a dreaded task — complicated tax calculations, ensuring compliance across multiple jurisdictions, managing direct deposits, and keeping meticulous records. Gusto has transformed this experience with a user-friendly interface and powerful automation that handles the complexities in the background.

What sets Gusto apart is its approach to creating a holistic platform where payroll, benefits, and HR tools work together seamlessly. This integration eliminates the need to manually transfer data between different systems or reconcile discrepancies, reducing both administrative burden and the potential for errors.

According to customer testimonials, businesses using Gusto save an average of 80 hours annually on payroll tasks alone. That’s two full work weeks you could reinvest in growing your business rather than managing administrative functions.

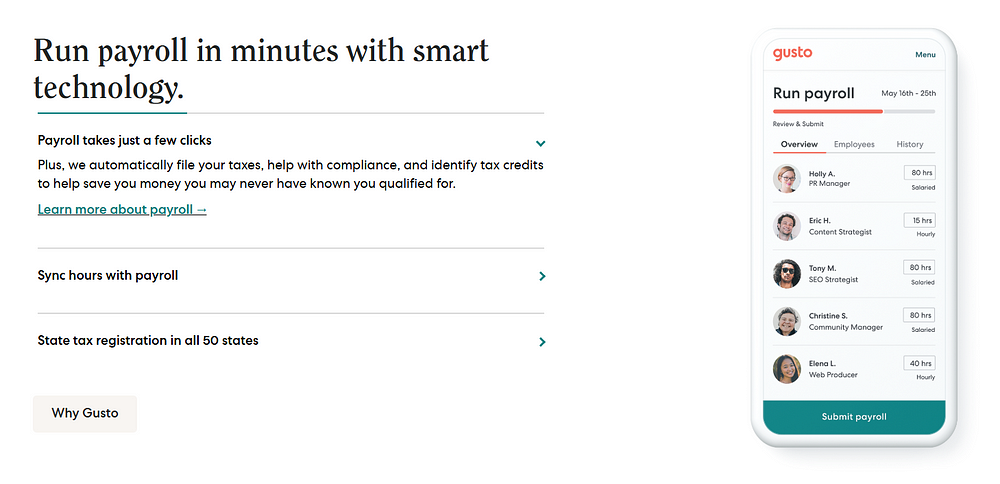

Comprehensive Payroll Features That Save You Time

Automated Tax Filing and Compliance

One of Gusto’s most valued features is its automated tax management system. The platform:

- Calculates, pays, and files federal, state, and local taxes automatically

- Provides tax registration assistance across all 50 states

- Issues and files W-2s and 1099s at year-end

- Offers a guarantee against tax penalties due to platform errors

This automation significantly reduces the risk of costly errors or missed deadlines that could result in penalties from tax authorities.

Flexible Payroll Processing

Gusto adapts to how your business operates rather than forcing you to change your processes. You can:

- Run unlimited payrolls at no extra cost

- Set up multiple pay schedules for different employee types

- Process both hourly and salaried employees

- Handle contractor payments alongside employee payroll

- Manage garnishments, reimbursements, and other special payroll situations

For businesses with changing needs or seasonal fluctuations, this flexibility proves invaluable.

Time Tracking Integration

In higher-tier plans, Gusto includes built-in time tracking that syncs directly with payroll processing. This integration:

- Eliminates manual data entry between systems

- Reduces errors in translating hours to payroll

- Simplifies approval workflows for managers

- Provides clear visibility into labor costs

Even if you use a separate time tracking system, Gusto offers integrations with popular platforms to maintain that seamless workflow.

Beyond Payroll: Comprehensive HR and Benefits Solutions

Simplified Benefits Administration

Offering competitive benefits is crucial for attracting and retaining talent, but managing these benefits traditionally required either significant administrative resources or expensive third-party brokers. Gusto simplifies this process by:

- Acting as your benefits broker at no additional cost

- Providing access to health, dental, vision, life, and disability insurance

- Offering retirement plans through Gusto 401(k)

- Supporting commuter benefits and health savings accounts

- Managing open enrollment and life event changes

The platform’s approach to benefits administration reduces paperwork while making it easier for employees to understand and select their benefits options.

Streamlined Hiring and Onboarding

First impressions matter, and a disorganized onboarding process can start the employer-employee relationship on the wrong foot. Gusto’s hiring and onboarding tools help create a smooth transition by:

- Providing job posting and applicant tracking features

- Creating customizable onboarding checklists

- Automating new hire paperwork including I-9 and W-4 forms

- Offering self-service employee portals for document access

- Sending welcome emails with key information

These features ensure that new hires have a positive experience from day one, allowing them to focus on their roles rather than paperwork.

Employee Development and Engagement

Beyond administrative functions, Gusto offers tools to help you build a stronger, more engaged team:

- Performance review frameworks

- Anonymous employee surveys

- Recognition tools and celebration tracking

- Development planning resources

- Team insights and reporting

By supporting the entire employee lifecycle, Gusto helps you build a workplace culture that attracts and retains top talent.

How Gusto Stacks Up Against Competitors

Gusto vs. Rippling

Rippling has emerged as a strong competitor with its unified platform for HR, IT, and finance. Where Rippling excels is in its device management capabilities, allowing businesses to provision and manage employee computers and software alongside HR functions.

However, Gusto generally offers a more intuitive user experience and more transparent pricing structure. For businesses that don’t need extensive IT management features, Gusto provides a more focused and often more cost-effective solution for payroll and HR needs.

Gusto vs. ADP Workforce Now

ADP is one of the oldest names in payroll services, with its Workforce Now platform targeting mid to large-sized businesses. ADP offers more extensive customization options and scales well for larger organizations with complex needs.

Gusto, by comparison, excels in simplicity and user experience, making it particularly well-suited for small to medium businesses without dedicated HR departments. Many businesses report that Gusto’s interface requires significantly less training than ADP’s more complex system.

Gusto vs. Paychex

Like ADP, Paychex has a long history in payroll services and offers a wide range of solutions for businesses of all sizes. Paychex typically requires more involvement from their representatives to implement and manage, which some businesses prefer for the personalized support.

Gusto’s self-service approach and modern interface appeal to tech-savvy business owners who prefer to manage systems themselves with on-demand support when needed.

Gusto vs. OnPay

OnPay is perhaps the most similar competitor to Gusto, offering straightforward payroll and HR tools for small businesses. OnPay offers a single pricing tier that includes most features, which can be simpler than Gusto’s tiered approach.

Where Gusto generally edges out OnPay is in the breadth of its ecosystem, particularly in benefits administration and the number of available integrations with other business software.

Gusto vs. Justworks

Justworks operates as a Professional Employer Organization (PEO), which means it becomes a co-employer with your business. This arrangement can provide access to better benefits rates typically available only to larger companies.

Gusto, while not a PEO, offers more flexibility and typically lower costs for businesses that don’t need the full co-employment model. Many businesses start with Gusto and migrate to a PEO like Justworks only when they reach a size where the benefits advantages outweigh the higher costs.

Pricing Structure: Finding the Right Fit for Your Business

Gusto’s tiered pricing model allows businesses to select the level of service that aligns with their needs and budget:

Simple Plan: For New and Single-State Businesses

At $40 per month plus $6 per person, the Simple plan offers:

- Full-service payroll with automated tax filing

- Employee self-service portals

- Paid time off management

- Basic reporting features

This plan works well for startups and businesses operating in a single state with straightforward payroll needs.

Plus Plan: For Growing Multi-State Companies

Priced at $80 per month plus $12 per person, the Plus plan adds:

- Multi-state payroll capabilities

- Built-in time tracking

- Project tracking and cost allocation

- Team management tools

- Hiring and onboarding features

This mid-tier plan represents the sweet spot for many growing businesses with employees in multiple states or more complex time tracking needs.

Premium Plan: For Businesses Needing Dedicated Support

At $180 per month plus $22 per person, the Premium plan includes:

- A dedicated customer success manager

- HR resource center

- Compliance alerts

- Direct phone access to HR experts

- Advanced reporting capabilities

The Premium tier is designed for businesses with complex compliance needs or those looking for more hands-on guidance with their HR functions.

Real-World Impact: How Businesses Benefit from Gusto

Time Savings and Operational Efficiency

The most immediate impact most businesses experience after implementing Gusto is a significant reduction in time spent on administrative tasks. With automated tax calculations, direct deposit processing, and report generation, payroll tasks that once took hours can be completed in minutes.

For business owners and managers, this time savings translates directly to more bandwidth for strategic initiatives and growth-focused activities.

Improved Employee Experience

From the employee perspective, Gusto provides a modern, user-friendly interface for accessing pay stubs, tax documents, and benefits information. The self-service portal empowers employees to update their own information, reducing administrative bottlenecks and ensuring data accuracy.

This improved experience extends to onboarding, where new hires can complete necessary paperwork electronically before their first day, allowing them to focus on integration and training rather than filling out forms.

Enhanced Compliance and Risk Management

Staying compliant with constantly changing employment laws and tax regulations is a significant challenge for small businesses. Gusto helps mitigate this risk by automatically updating its systems to reflect regulatory changes and providing alerts about compliance requirements.

This proactive approach to compliance reduces the likelihood of costly penalties and gives business owners peace of mind that their payroll and HR functions are operating within legal parameters.

Is Gusto Right for Your Business?

Ideal Use Cases for Gusto

Gusto is particularly well-suited for:

- Small to medium-sized businesses with 1–100 employees

- Startups looking for scalable HR infrastructure

- Companies without dedicated HR departments

- Businesses seeking to offer competitive benefits

- Organizations with a mix of employees and contractors

The platform shines in environments where administrative efficiency is valued and where team members appreciate modern, digital-first solutions.

Scenarios Where Alternatives Might Be Better

Gusto may not be the optimal choice for:

- Enterprise-level organizations with thousands of employees

- Businesses with highly complex payroll requirements

- Companies needing extensive customization of HR workflows

- Organizations requiring international payroll capabilities

- Businesses seeking the lowest possible cost regardless of features

In these scenarios, alternatives like ADP, Paychex, or industry-specific solutions might be more appropriate.

Getting Started with Gusto: A Practical Approach

If you’re considering implementing Gusto, here’s a straightforward approach to evaluation and onboarding:

- Start with a demo: Schedule a demonstration to see the platform in action and ask specific questions about your business needs.

- Review your current payroll schedule: Gusto works best when implemented at the beginning of a pay period or quarter.

- Gather necessary information: Prepare employee details, tax ID numbers, and banking information to streamline the setup process.

- Plan for transition time: Allow 1–2 weeks for full implementation, particularly if you’re transferring from another system.

- Utilize Gusto’s support resources: Take advantage of Gusto’s implementation specialists to ensure proper setup.

Most businesses report that the transition to Gusto is smoother than expected, with many successfully running their first payroll within days of starting the implementation process.

Empowering Businesses to Focus on What Matters

In today’s competitive business environment, operational efficiency can make the difference between thriving and merely surviving. By automating and streamlining payroll, HR, and benefits management, Gusto enables small and medium-sized businesses to redirect valuable time and resources toward core business activities.

With its user-friendly interface, comprehensive feature set, and scalable pricing model, Gusto has positioned itself as a leading solution for businesses seeking to modernize their administrative functions without breaking the bank.

Whether you’re a startup running your first payroll or a growing business looking to upgrade from outdated systems, Gusto offers a compelling combination of functionality, ease of use, and value that merits serious consideration.