Master Your Money Worldwide: A Deep Dive into Wise’s Revolutionary Platform

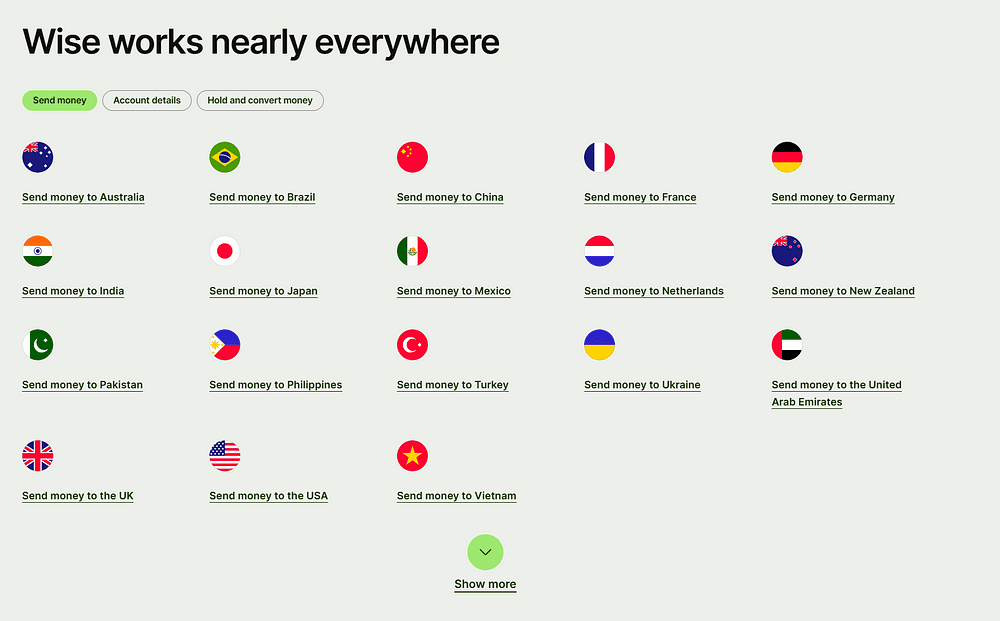

Imagine a world where managing your money internationally isn’t a maze of hidden fees and confusing exchange rates. You deserve a financial tool that puts you in control — one that’s modern, transparent, and truly global. That’s where Wise steps in. With a mission to make international money transfers fair and simple, Wise has become the go-to solution for millions worldwide, including savvy users like you in the United States.

What is Wise?

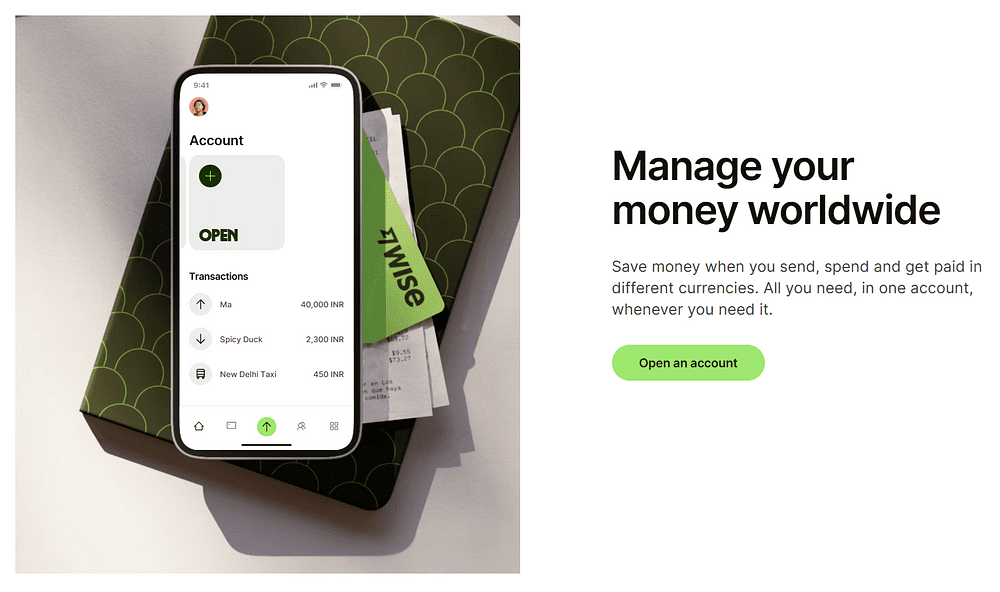

You might have heard of Wise, formerly known as TransferWise. Founded with a vision to revolutionize how money moves across borders, Wise offers an online platform that cuts out the middlemen and saves you money. It empowers over 12.8 million customers to transfer billions every quarter by providing clear, upfront pricing and a user-friendly interface. Whether you’re sending a small amount to family overseas or managing a business that operates in multiple currencies, Wise is designed to meet your needs without the hefty fees traditional banks charge.

Key Features of Wise

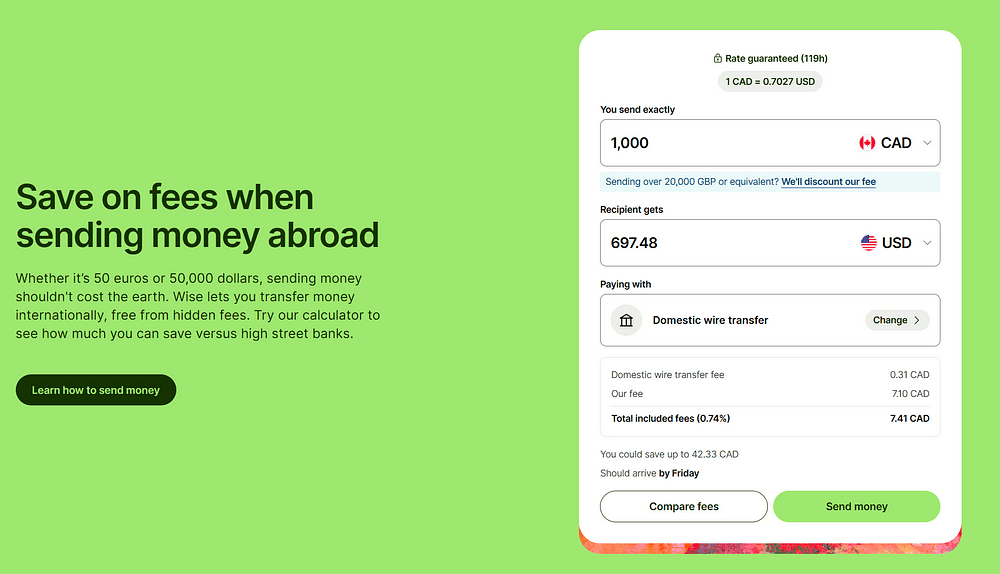

- Transparent Pricing:

With Wise, you always know what you’re paying. Instead of hidden fees and surprise markups, you see a detailed breakdown before you confirm your transfer. This transparency means that you can compare and calculate your savings instantly, ensuring that every dollar (or pound) works harder for you.

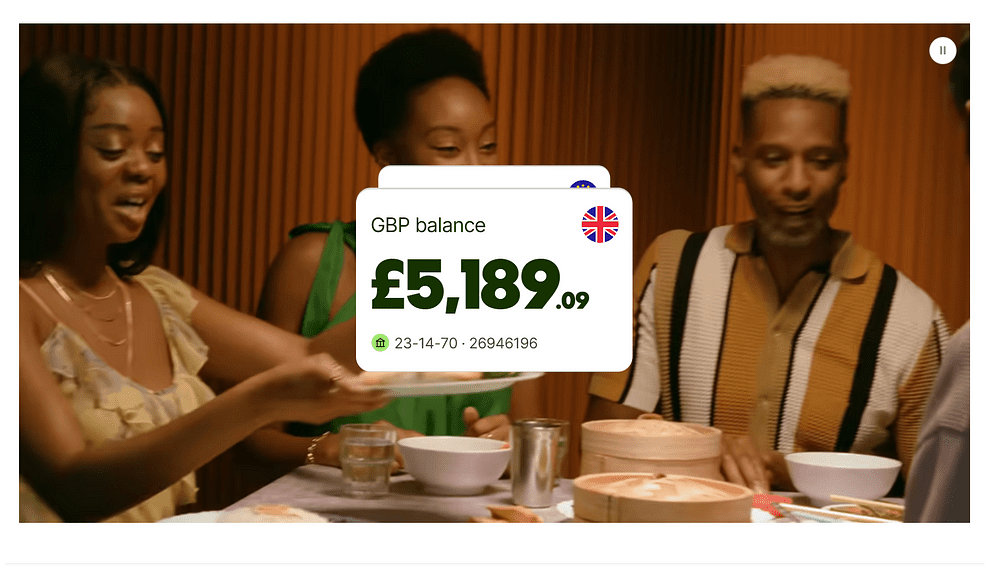

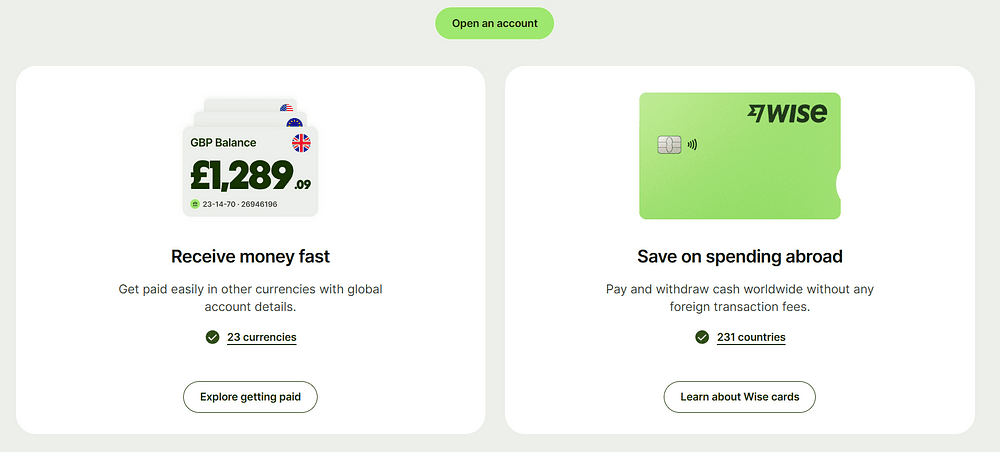

- Multi-Currency Account & Debit Card:

Imagine holding and spending money in more than 40 currencies from a single account. Whether you’re traveling, shopping online internationally, or running a global business, the Wise multi-currency account lets you receive, convert, and spend with ease. The Wise debit card enables you to make purchases and withdraw cash worldwide without foreign transaction fees — keeping your money in your control wherever you go. - Security & Reliability:

- When it comes to your finances, security is paramount. Wise employs state-of-the-art fraud detection systems, two-factor authentication, and partnerships with established financial institutions to ensure that your money is safe. Their regulatory credentials — including authorization by bodies like the Financial Transactions and Reports Analysis Centre of Canada — give you peace of mind every time you transact.

- Business Solutions:

If you’re a business owner, you know that managing international payments can be complex. Wise offers tailored business accounts that allow you to pay suppliers, receive payments from clients, and manage expenses in over 40 currencies. This solution not only simplifies your operations but also helps you save on fees — allowing you to reinvest in your business.

The Competitive Landscape

You might wonder how Wise compares to other players in the market. While traditional banks like Western Union and MoneyGram have long dominated the money transfer space, they often come with higher fees and slower processing times. On the other hand, fintech competitors like Revolut, PayPal/Xoom, and Remitly offer alternatives, but each has its own limitations. For instance, Revolut is well-known for its multi-currency features, yet it sometimes falls short in transparency and customer support. PayPal’s Xoom is fast but can be costly, especially for smaller transfers. Wise stands out by combining low, transparent fees with a user-friendly platform — making it a superior choice for many users like you.

How Wise Empowers You

Think about your daily financial needs. Whether you’re paying bills, sending money to family abroad, or managing a small business, Wise puts the power directly in your hands. With a focus on real exchange rates and low fees, you can keep more of your hard-earned money. Plus, its regulatory oversight and robust security protocols mean that you’re protected every step of the way. In today’s globalized world, having a tool that simplifies cross-border transactions isn’t just convenient — it’s essential.

User Experience & Customer Reviews

As you explore your options, consider what other users are saying. Wise consistently earns high ratings on both the App Store and Google Play, with reviews praising its speed, reliability, and ease of use. Many customers share stories of how Wise has made international transfers stress-free — transforming what used to be a daunting process into a seamless part of their financial routine.

Why Wise is Your Best Choice

At the end of the day, your money should work for you — not against you. Wise offers a modern, innovative solution that not only saves you money through lower fees but also provides the tools you need to manage your finances globally. Its competitive edge lies in transparency, efficiency, and a relentless focus on user experience. Whether you’re a frequent traveler, a global entrepreneur, or someone sending remittances to loved ones overseas, Wise gives you the confidence and control to manage your money the smart way.

Conclusion

Now is the time to make a change. You deserve a financial platform that keeps up with your modern lifestyle — one that offers transparency, security, and a truly global reach. With Wise, you can say goodbye to hidden fees and confusing exchange rates, and hello to a new era of international money management. Ready to take control of your global finances? Visit Wise’s website today, sign up, and experience the difference for yourself. Your money, your world — managed simply, efficiently, and intelligently.